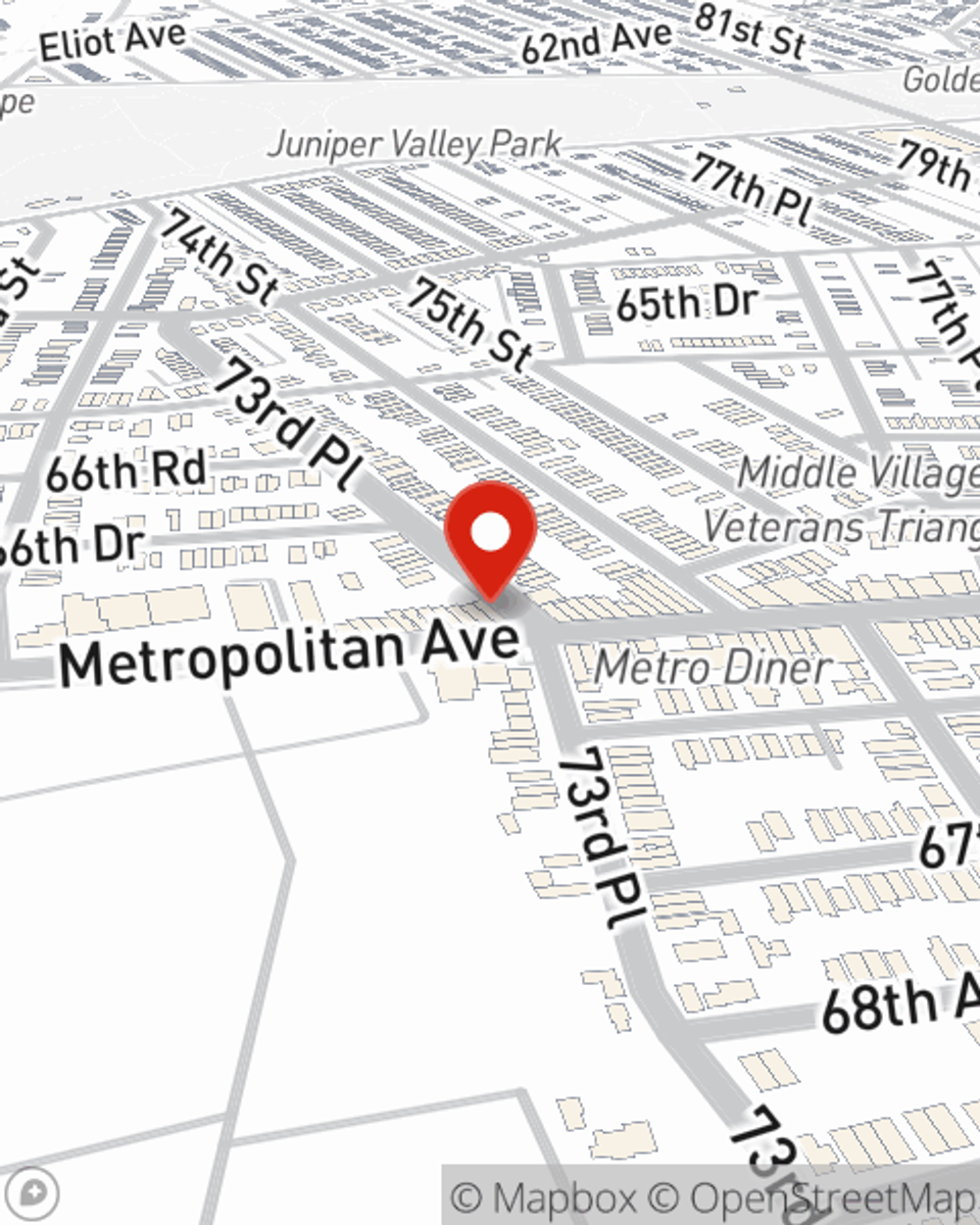

Business Insurance in and around Middle Vlg

Researching protection for your business? Search no further than State Farm agent Chris Tobar!

Insure your business, intentionally

Help Prepare Your Business For The Unexpected.

Whether you own a a lawn care service, a home improvement store, or a bakery, State Farm has small business protection that can help. That way, amid all the various options and moving pieces, you can focus on what matters most.

Researching protection for your business? Search no further than State Farm agent Chris Tobar!

Insure your business, intentionally

Customizable Coverage For Your Business

The passion you have to be a leader in your field is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Chris Tobar. With an agent like Chris Tobar, your coverage can include great options, such as artisan and service contractors, commercial liability umbrella policies and commercial auto.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Chris Tobar is here to help you learn about your options. Reach out today!

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Chris Tobar

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.